Never before has it been so easy to process bank data and maintain an up-to-date liquidity overview. Account transactions can be imported into Abacus Electronic Banking securely, automatically and at any time via connection to a bank account. Many financial institutions are already directly linked. Account transactions can also be imported manually.

During the subsequent process of importing the account transactions, bank data passes through a set of rules in Abacus Electronic Banking. This turns bank transactions into bookings. An automatic reconciliation of the open items is also carried out using the corresponding rules. The open items are then cleared and settled when they are credited or debited to the bank account. For partial payments, the balance remains open. The payment conditions are taken into account, so that, for example, payments with cash discount deductions can also be made automatically.

Account transactions that do not affect documents in the subledgers are entered directly in the financial accounting. Recurring entries, such as rent, can be automated by using a set of rules. Three options are available for account transactions that cannot be processed automatically: create a new rule, assign the transaction to an existing rule or create a manual entry. Such account transactions can also be entered manually in the financial accounting, accounts receivable or accounts payable.

The rule set option allows the bank's account transactions to be processed, or booked, efficiently, securely and with consistent quality.

Your benefits

The central and easy-to-use software supports you in the smooth, secure processing of your financial transactions and optimises payment transactions. Abacus Electronic Banking also offers you the following advantages:

Safe

Efficient and secure transmission of payment orders to financial institutions from a central application.

Tested

Compliance with the internal audit guidelines for the release of payment orders.

Practical

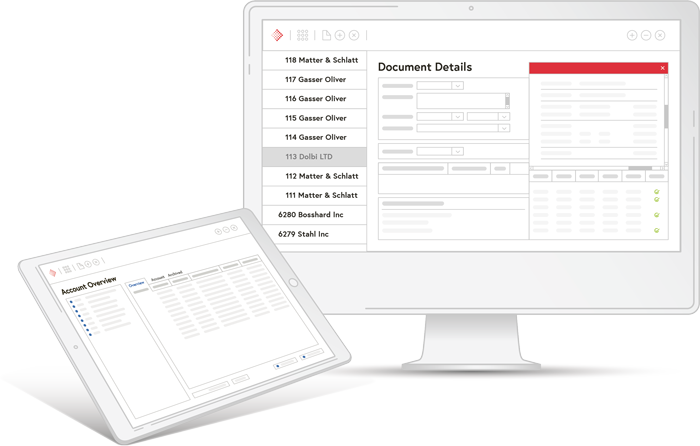

Daily updated overview of the transactions and account balances of all cash accounts.

Practical insight from BMU Treuhand AG

Watch the video to find out how BMU Treuhand AG has digitalised its banking processes and what advantages the "Post account transactions" option brings to day-to-day business.

Process overview: Enter account transactions

Import account transactions

The account transactions are imported.

Apply set of rules

The rules are created once. Recurring postings, such as rental expenses, can be posted automatically using the defined set of rules.

Post payments

Payments are posted in financial accounting and open items are closed and posted in accounts receivable or accounts payable. Any error postings are posted manually to financial accounting, accounts receivable or accounts payable. A new rule can also be created so that the payment can be posted automatically in future.

Have we sparked your interest?

We would be happy to advise you individually on our software solutions. Please fill out our contact form.

What might also interest you

Electronic Banking

The software for Swiss payment transactions

Factsheet

Enter Account Transactions - Abacus Electronic Banking