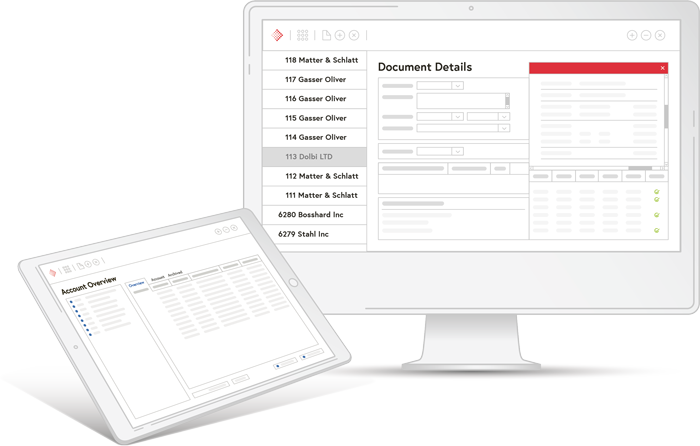

Abacus Electronic Banking can execute payments for other Abacus programs or transfer data from third-party applications such as SAP to financial institutions. Electronic payment transactions via Abacus Electronic Banking are made using the latest technologies and security solutions. Integration in the Abacus programs Accounts Receivable, Accounts Payable, Payroll and General Ledger optimises your processing and saves time and money. The program can also be used as a stand-alone solution.

Electronic Banking supports all major Swiss financial institutions and, as a multi-bank-capable programme, can simultaneously serve several institutions with different interfaces with payment orders.

Authorized employees may release payments within defined limits. This can be a collective or a single release.

The setup wizard assists you in setting up new institutions and configuring the interfaces. Payment orders, confirmations and current account balances are processed and updated in one step. In addition, processing may be automated with the help of "Schedulers".

A selection of connected banking institutions

Electronic Banking at a glance

Incoming and outgoing payments and account management are the central components of the Abacus Electronic Banking application. All functions at a glance are below:

Incoming payments

- Direct debit transactions

- Debit Direct

- QR processing

- Payment of customer credit

Disbursements

- Pain.001 CH, DE, AT

- SEPA = European payment transactions

- AZV = Foreign payment transactions in Germany

- Standing orders and templates

- Enter Account Transactions

Account management

- Account statements according to ISO 20022 (Camt.052/053/054)

- Confirmations (pain.002)

- Post account movements

- Enter Account Transactions

Your benefits

The central and easy-to-use software supports you in the smooth, secure processing of your financial transactions and optimises payment transactions. Abacus Electronic Banking also offers you the following advantages:

Safe

Efficient and secure transmission of payment orders to financial institutions from a central application.

Tested

Compliance with the internal audit guidelines for the release of payment orders.

Practical

Daily updated overview of the transactions and account balances of all cash accounts.

Enter Account Transactions

The integrated and automated solution for reconciling open debit and credit items and booking recurring and individual entries to the financial accounting.

Practical insight from BMU Treuhand AG

Watch the video to find out how BMU Treuhand AG has digitalised its banking processes and what advantages the "Post account transactions" option brings to day-to-day business.

4,000

customers have chosen Abacus Electronic Banking

10,000

users work with Abacus Electronic Banking every day

Frequently asked questions about Abacus Electronic Banking

Which banks are supported by Abacus Electronic Banking?

Abacus Electronic Banking supports all banks with EBICS in Switzerland, Germany, Austria and the Principality of Liechtenstein. You can find a selection of supported Swiss banks here:

- Aargauische Kantonalbank

- acrevis Bank AG

- Appenzeller Kantonalbank

- Bank Cler

- Banque Cantonale de Fribourg

- Banque Cantonale de Genève

- Banque Cantonale du Jura

- Banque Cantonale du Valais

- Banque Cantonale Neuchâteloise

- Banque Cantonale Vaudoise

- Basellandschaftliche Kantonalbank

- Basler Kantonalbank

- Berner Kantonalbank

- Glarner Kantonalbank

- Graubündner Kantonalbank

- Liechtensteinische Landesbank Aktiengesellschaft

- Luzerner Kantonalbank

- MIGROSBANK

- Nidwaldner Kantonalbank

- Obwaldner Kantonalbank

- POSTFINANCE

- Raiffeisenbank

- Schaffhauser Kantonalbank

- Schwyzer Kantonalbank

- St. Galler Kantonalbank

- Thurgauer Kantonalbank

- UBS Group AG

- Urner Kantonalbank

- VALIANT BANK AG

- Vorarlberger Landes- und Hypothekenbank AG

- VZ VermögensZentrum AG

- Zuger Kantonalbank

- Zürcher Kantonalbank

(Subject to change, all information without guarantee.)

What does EBICS mean?

The EBICS interface is a fast and secure communication channel that ensures electronic access for your payment transactions. EBICS stands for Electronic Banking Internet Communication Standard.

Abacus supports the EBICS interface in the DACH region.

You can find a selection of banks with an EBICS interface here:

- Credit Suisse

- UBS

- Postfinance

- St.Galler Kantonalbank

- Züricher Kantonalbank

- Alle Banken in Deutschland

- Alle Banken in Österreich

(Subject to change, all information without guarantee.)

Which interfaces to banks are supported by Abacus Electronic Banking?

The following interfaces are supported:

- Avaloq

- Baloise Bank SoBa

- CLX Office Business

- EBICS 2.5 und 3.0

- E-Finance

- E-Link 3.0

- ELSTER (Steuerdatenübermittlung)

- Finnova

- Intersystem

- Krokus E-Banking

- LLB / Linth Connect

- Quick Link

- Raiffeisen Direct

- Topas

- YAPEAL

(Subject to change, all information without guarantee.)

Which terminal providers are supported by Abacus Electronic Banking?

The following providers are supported:

- Payrexx

- SFTP (UBS, Swisscard, SIX)

- SIX Topas

- Sumup

(Subject to change, all information without guarantee.)

Which credit card providers are supported by Abacus Electronic Banking?

The following providers are supported:

- Cornèrcard

- YAPEAL Card

- Viseca

- UBS Card Center

(Subject to change, all information without guarantee.)

Other documents

Flyer

Electronic Banking

Factsheet

Enter Account Transactions

Have we sparked your interest?

We would be happy to advise you individually on our software solutions. Please fill out our contact form.

What might also interest you

Financial Accounting

The software for General Ledger, Accounts Payable, Accounts Receivable, Cost Accounting and E-Banking

Payroll

The payroll software for all company sizes and industries